Our Investment Process

How We Invest

At First Row Partners, we invest at the very earliest stages. Our process is designed to move quickly, respect your time, and add value — even before we write the check.

Here are a few principles you can expect:

Swift & decisive: Most decisions take 2–3 weeks (and can move faster when materials are ready).

Founder-first: Every step is meant to sharpen your thinking, not just ours.

Preparation for partnership: The topics we develop during our diligence flow directly into post-investment support.

What the Process Looks Like

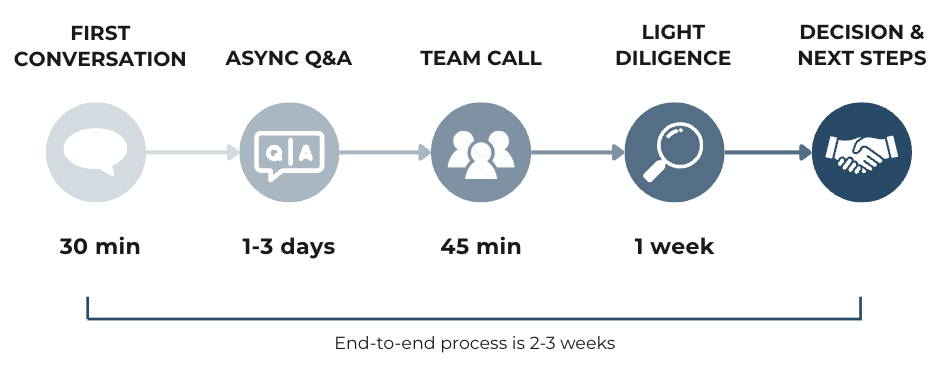

First Conversation [30 min] → A real conversation, not a deck walkthrough, with one of the Partners. We focus on your insight, customers, and the world you’re building.

Async Q&A [1–3 days] → A short Google Doc exchange on the biggest opportunities and risks. This keeps things efficient and shows you what matters in our analysis.

Team Call [45 min] → You’ll meet the full FRP team. We go deeper on strategy, challenges, and long-term vision. It’s as much for you to evaluate us as for us to evaluate you. We provide founder references, as requested.

Light Diligence [1 week] → We review the essentials — cap table, financials, references.

Decision & Next Steps → Once the Partner champion is ready to invest, we can sign and wire fast. When we invest, the shift into partnership mode is immediate. We do our best to meet in person during the first months.

After We Invest

We aim to be the “most helpful, least annoying investor” on your cap table. It begins with a well-organized onboarding experience:

Two Partner onboarding meetings to align on meeting check-in cadence, updates, and immediate needs.

Pick a book we can send you from our Reference Bookshelf.

Join our Founder Resource Hub with workshops recordings, templates, and startup perks/credits.

Join our private Slack community for quick support and resource-sharing. But, text us anytime!

Fast, consistent responses to your updates and asks.

Ready to pitch?

Learn more about how we use arts-based approaches in the context of venture investing.